Key takeways

- BFSI institutions offer banking and financial products or services and serve as intermediaries between financial institutions and customers.

- The BFSI sector plays a crucial role in fostering economic growth and is of significant importance to individuals, businesses, and the overall economy.

- The adoption of RPA in BFSI continues to grow as organizations recognize its potential for cost savings, process optimization, and competitive advantage.

- Strong project management, effective communication, and continuous monitoring are key to a successful RPA implementation in the BFSI sector.

- The combination of RPA and AI technologies enables organizations in the BFSI sector to achieve higher levels of automation, efficiency, and intelligence.

BFSI stands for Banking and Financial Services and Insurance. These institutions facilitate various financial transactions. They essentially offer banking and financial products or services. They serve as intermediaries between financial institutions and customers.

In simple terms, BFSI operates as an investor deposits a certain amount in a bank or a financial institution. Banks and financial institutions offer the deposited amount as loans or other investments to investors.

The scope of BFSI-Banking, Financial Services, and Insurance covers different sectors and functions within the financial industry. It involves the management and provision of banking services, risk management, financial inclusion, and economic development.

The BFSI sector plays a crucial role in fostering economic growth and is of significant importance to individuals, businesses, and the overall economy. Governments of different countries have a specific regulatory framework to control the flow of money into the economy.

According to a recent report by Data Bridge’ “Financial Services, Global Banking, and Insurance Market is predicted to cross USD 119.21 Billion by 2029”. (Source- Databridgemarketresearch)

The BFSI sector is facing several challenges that require the BFSI entities to rethink their working methodology.

- Challenges Before the BFSI Sector

- What is RPA?

- What is RPA in Banking, Financial Services Industry?

- Some Key Advantages of Implementing RPA in BFSI

- Steps to implement RPA in BFSI

- Common challenges in RPA Adoption and Integration in BFSI

- Overcoming Challenges by Combining RPA and AI

- Future of RPA in the BFSI Industry

Some of the Challenges Before the BFSI Include

Growth of Fintech Companies

The BFSI sector faces severe competition because of the growth of Fintech companies. These companies target the most profitable areas in the financial sector resulting in the loss of revenue to traditional banking and financial sector institutions.

Changes in Regulations

Since 2008, regulatory compliance factors have posed a challenge for the BFSI sector. The regulatory fees have increased drastically when compared to earnings and credit losses. The changing regulatory compliance rules are increasing difficulties for banks and other financial institutions as they need to correlate data from disparate sources.

Rising Customer Demands

The awareness levels have increased in today’s BFSI customers thanks to easy access to data. They expect a high degree of personalization in the services offered.

Security Concerns

Increasing security breaches are posing a major challenge to the BFSI sector.

Obsolete Systems

Legacy systems include several manual processes that are slow and error-prone. These inefficient systems cannot meet customer demands and lead to poor customer experience.

Digital transformation is the way ahead for the BFSI sector. The adoption of RPA in BFSI continues to grow as organizations recognize its potential for cost savings, process optimization, and competitive advantage. BFSI organizations deal with large volumes of data, including customer information, transactions, and financial records and here RPA can automate tasks by extracting data from various sources, validating it against predefined rules, and populating it into target systems.

What is RPA?

RPA technology enables organizations to automate routine, manual tasks that are typically performed by humans, thereby improving efficiency, accuracy, and productivity. The technology is particularly effective in automating rule-based tasks that follow predefined rules and instructions. The robots operate based on predefined rules, workflows, and decision trees, enabling them to execute tasks consistently and accurately.

The successful RPA implementation can be seen across various industries and sectors, including banking, insurance, healthcare, finance, manufacturing, customer service, human resources, and supply chain management. It offers significant benefits such as improved operational efficiency, cost reduction, enhanced accuracy, increased productivity, faster processing times, and the ability to free up human resources for more complex and strategic tasks.

What is RPA in the BFSI Sector?

RPA is widely used in the BFSI sector to streamline and automate a range of processes and tasks.

Leveraging RPA in BFSI can help organizations achieve increased operational efficiency, reduced manual errors, faster processing times, improved compliance, and enhanced customer experience. However, it’s important to note that while RPA can automate repetitive tasks, it may require human oversight and intervention for more complex and judgment-based processes.

As per Accenture data, 70% of respondents believed that Robotic Process Automation can be a game changer in compliance. RPA implementation enhances the productivity and quality of the compliance process. (Source- Automationedge)

Some Key Advantages of Implementing RPA in BFSI

Improved Functional Efficiency

RPA automates manual, repetitive tasks, reducing the need for human intervention. By leveraging software robots, BFSI organizations can significantly enhance operational efficiency by executing processes faster, reducing errors, and improving process accuracy and consistency.

Enhanced Accuracy and Compliance

RPA can ensure regulatory compliance and reduce the risk of errors or omissions in BFSI processes. By automating compliance checks, data validation, and report generation, RPA helps organizations maintain adherence to regulatory requirements, reducing the risk of non-compliance penalties.

Quicker Processing and Turnaround times

RPA accelerates process cycle times by performing tasks at high speed without the limitations of human capacity. This allows BFSI organizations to expedite critical processes, such as loan processing, claims settlement, and account reconciliation, resulting in faster service delivery and improved customer satisfaction.

Data Accuracy and Analytics

Robots follow predefined rules and perform tasks consistently, minimizing data entry mistakes or data discrepancies. Additionally, RPA can enhance data security by restricting access to sensitive information and enforcing data encryption protocols.

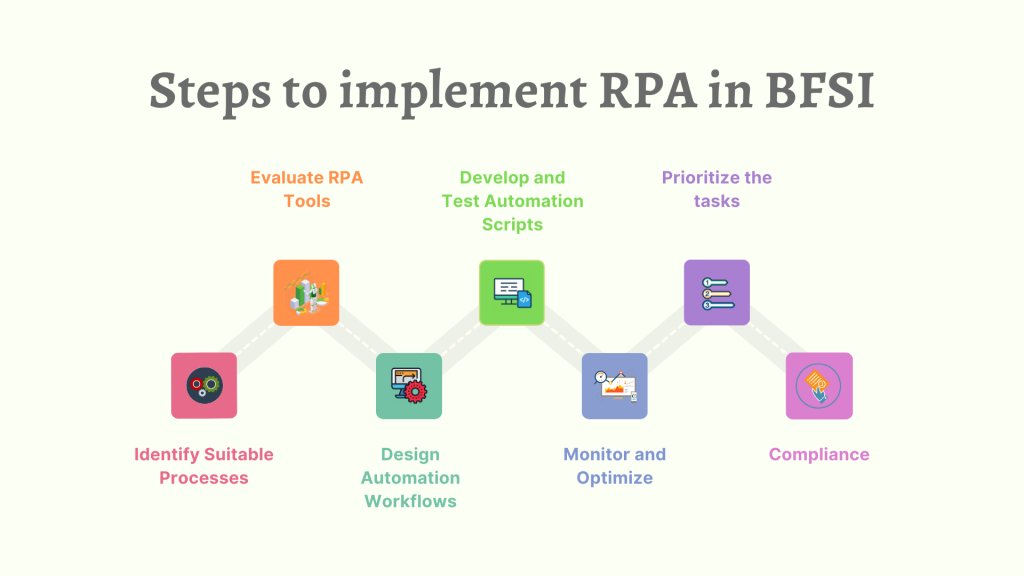

Steps to implement RPA in BFSI

RPA implementation is a collaborative effort involving business stakeholders, IT teams, and RPA experts. Strong project management, effective communication, and continuous monitoring are key to a successful RPA implementation in the BFSI sector.

Identify Suitable Processes

Begin by identifying the processes within BFSI that are suitable for automation. Look for repetitive, rule-based tasks that involve high volumes of data, have well-defined rules, and are prone to human error. Examples include data entry, report generation, account opening, KYC compliance, claims processing, and reconciliation.

Evaluate RPA Tools

Research and evaluate RPA tools available in the market. Look for tools that meet the specific needs of BFSI, such as integration capabilities, security features, scalability, and support for compliance requirements.

Design Automation Workflows

Design the automation workflows by defining the sequence of actions to be performed by the RPA software robots. Specify the input data sources, data validations, decision points, and desired outputs. Develop process maps or flowcharts to visualize the automation workflows and obtain stakeholders’ feedback.

Develop and Test Automation Scripts

Use the selected RPA tool to develop automation scripts or workflows based on the designed automation workflows. Configure the software robots to perform the identified tasks, such as data entry, data extraction, validation, and system interactions.

Monitor and Optimize

Continuously monitor the performance of the deployed RPA solution. Track key metrics such as process cycle times, error rates, cost savings, and customer satisfaction. Identify bottlenecks, areas for optimization, and opportunities for further automation.

Prioritize the tasks

After successful pilot implementation, scale up the RPA deployment to cover additional processes or tasks. Prioritize the processes based on their potential benefits and impact. Establish guidelines and best practices for automation, ensuring proper governance, security, and compliance. Train employees on working with RPA and encourage adoption.

Compliance

Set up proper governance practices for RPA implementation. Establish specific roles and responsibilities, access controls, and change management processes. Ensure compliance with data privacy and security regulations, audit requirements, and internal policies. Regularly review and update the governance framework as needed.

Common challenges in RPA Adoption and Integration in BFSI

Process Complexity

BFSI processes can be complex, involving multiple systems, data sources, and compliance requirements. Automating such processes can be challenging due to variations in data formats, system compatibility issues, and intricate workflows. Ensuring that the RPA solution can handle the complexity and nuances of BFSI processes is crucial.

Regulatory Compliance

The BFSI sector deals with sensitive customer data and operates under strict regulatory compliance requirements. Implementing RPA requires ensuring data security, privacy, and compliance with regulations. Organizations must establish robust security measures and data governance frameworks to address these concerns.

Data protection

With the deployment of RPA, organizations must establish proper governance frameworks to manage the automation processes, monitor the performance of bots, and ensure compliance. It is essential to have controls in place to mitigate risks associated with error-prone bots, unauthorized access, or improper use of RPA tools.

Process Standardization

Optimization is necessary to realize the full potential of automation. Identifying opportunities for further automation, eliminating bottlenecks, and continuously improving the automation workflows require dedicated effort and continuous monitoring.

Overcoming Challenges by Combining RPA and AI

The combination of RPA and AI technologies enables organizations in the BFSI sector to achieve higher levels of automation, efficiency, and intelligence. It empowers them to automate complex processes, make data-driven decisions, enhance customer experiences, improve risk management, and drive business growth.

Customer Support

RPA-powered bots can provide round-the-clock customer support, ensuring that customers can receive assistance at any time. These bots can handle routine inquiries, process transactions, and provide basic support outside of regular business hours. RPA eliminates the need for manual intervention, enabling continuous support and reducing response times, resulting in improved customer satisfaction.

Risk Management

AI algorithms can analyze large volumes of data and detect patterns indicative of fraud or risk. By integrating AI with RPA, organizations can automate the detection of suspicious activities, flag potentially fraudulent transactions, and initiate appropriate actions. This combination enhances risk management capabilities and helps prevent financial losses.

Customized Services

AI algorithms can analyze customer preferences, transaction history, and behavior patterns, to deliver personalized experiences. By combining AI with RPA, customer support systems can leverage this data to provide tailored recommendations, product suggestions, or personalized offers.

Future of RPA in the BFSI Industry

The future of RPA in BFSI is not about replacing humans but augmenting their capabilities. RPA will enable human-robot collaboration, where humans and bots work together to achieve optimal results.

In the future, BFSI organizations will increasingly adopt RPA to automate a wider range of processes beyond basic, repetitive tasks. As RPA technology advances and becomes more sophisticated, organizations will leverage it to automate complex processes involving unstructured data, decision-making, and cognitive tasks.

RPA combined in the BFSI industry will bring expanded automation, integration with AI and cognitive technologies, hyper-automation, compliance and risk management capabilities, intelligent virtual assistants, enhanced data analytics, and human-robot collaboration. Such trends will drive digital transformation, improve operational efficiency, and deliver enhanced customer experiences in the BFSI sector.

Connect with the experts at Auxiliobits for the best RPA solutions for your business!

Watch this space for more blogs on Automation!